Wynn at Law, LLC has helped many Wisconsin residents get a fresh start financially. When seeking relief from overwhelming debt, filing for bankruptcy may be one of the best options.

Wynn at Law, LLC’s bankruptcy lawyers review each client’s financial situations to identify solutions for getting them out of debt. If bankruptcy is the right option, Wynn at Law, LLC’s lawyers will help select the correct Chapter of bankruptcy that best fits the client’s situation. Wynn at Law, LLC will guide the client through the complex bankruptcy process and will make sure the client understands every step along the way.

This helpful guide answers the commonly asked questions about bankruptcy and highlights options for managing debt.

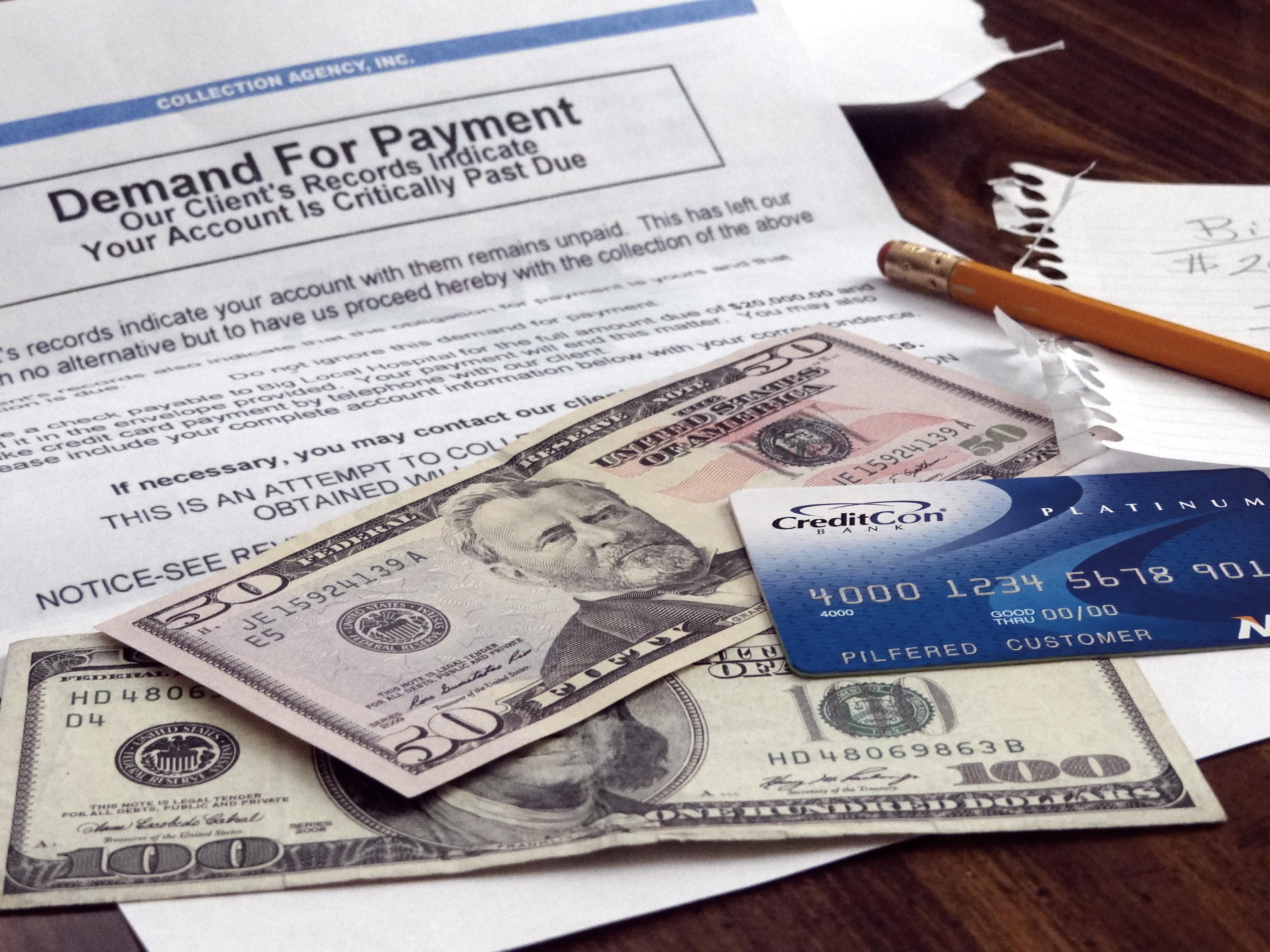

Personal bankruptcy is essentially the declaration that an individual is unable to repay his/her existing debts that are owed to creditors. Bankruptcy is a uniform procedure that is supervised by federal courts. There are two primary types of bankruptcy protection for individuals in Wisconsin: Chapter 7 Bankruptcy and Chapter 13 Bankruptcy. There is also an alternative to bankruptcy through debt repayment called Chapter 128 Debt Amortization.

The experienced lawyers at Wynn at Law, LLC help clients navigate the complex bankruptcy filing process. Wynn at Law, LLC’s lawyers identify which type of bankruptcy or debt relief option best fits a client’s current financial situation.

Most people filing for bankruptcy view eliminating debt and protecting their assets as the primary goals. Depending on the type of bankruptcy, all or most debts can be discharged or “wiped out”. The types of debt that can often be eliminated include medical bills, utility bills, payday loans, vehicle repossession debt and credit card debt.

An individual filing for bankruptcy in Wisconsin can also benefit in the following ways:

Declaring bankruptcy is an option to consider when seeking relief from overwhelming debt. It is often recommended to speak with a lawyer, such as those at Wynn at Law, LLC for personalized legal advice.

Several factors are used to determine if an individual is eligible to file for bankruptcy in Wisconsin. In many cases, it is worth exploring bankruptcy if an individual is unable to make on-time payments with bills, has extensive credit card or medical debt, or is facing foreclosure or repossession.

When an individual is stuck in a difficult financial situation, they should not feel ashamed to get help. Wynn at Law, LLC works with couples, families, and individuals in Wisconsin that are facing bankruptcy and financial hardship. Some of the most common reasons people seek solutions for debt relief include:

Everyone deserves the opportunity to live a financially independent and debt-free life. For some, bankruptcy creates the foundation for a better financial future. If an individual chooses to file for bankruptcy, they are not alone. Over 16,000 people in Wisconsin declare bankruptcy each year. Popular celebrities have filed bankruptcy, such as Burt Reynolds, Teresa Giudice, Larry King, Cyndi Lauper, Mark Twain, Henry Ford, and Walt Disney.

The two most common types of bankruptcy protection in Wisconsin are called Chapter 7 and Chapter 13. There is also a legal alternative to bankruptcy called Chapter 128 Debt Amortization. Each of these options has different qualifications and requirements. Individuals who are struggling financially should contact the experienced bankruptcy lawyers at Wynn at Law, LLC. Schedule a free consultation today to create a personalized debt management strategy. Call Wynn at Law, LLC at 262-725-0175 to schedule an appointment or continue reading to learn more about these types of bankruptcy.

Most Wisconsin residents file under Chapter 7 of the Bankruptcy Code, which is sometimes known as “straight” or “liquidation” bankruptcy. Chapter 7 Bankruptcy gives an individual the opportunity to eliminate a large portion of their debt — credit cards, personal loans, medical bills, and other unsecured debts. In the vast majority of cases, the individual can still keep their house, vehicle, retirement account and personal property. To file for Chapter 7 Bankruptcy, an individual must qualify according to a Means Test. Typically, if the individual’s monthly household income is less than the average monthly income for households of the same size in Wisconsin, known as the median household income, he/she will be able to file for Chapter 7 Bankruptcy. Wynn at Law, LLC’s lawyers make sure that their clients are informed throughout the entire Chapter 7 process. Chapter 7 Bankruptcy is a perfectly acceptable solution to debt in this difficult economy. Once an individual’s debts have been discharged, they will be able to focus on building a debt-free future.

Learn More About Chapter 7 Bankruptcy

Schedule a Chapter 7 Consultation

Chapter 13 Bankruptcy allows individuals to consolidate, reorganize, and restructure unsecured debt using a repayment plan. Chapter 13, also referred to as “wage-earner” or “debt-adjustment” bankruptcy, is available to individuals that intend to use future disposable income to pay some or all of one’s debts. Individuals or households that do not meet the Chapter 7 “Means Test” qualifications often turn to Chapter 13 Bankruptcy. Chapter 13 Bankruptcy can also be used to avoid foreclosure and repossession of cars, appliances, and goods that are covered in the repayment plan. Typically, when establishing a repayment plan under Chapter 13, an individual must repay an agreed-upon portion of his/her debt over a 3 to 5 year period. Wynn at Law, LLC works with clients to prepare and file Chapter 13 Bankruptcy documents and personalized repayment plans. Wynn at Law, LLC works hard to make sure that clients are treated fairly throughout the process, while also ensuring a fast and smooth filing.

Learn More About Chapter 13 Bankruptcy

Schedule a Chapter 13 Consultation

A Wisconsin Chapter 128 debt amortization plan is a low-cost alternative to bankruptcy and debt consolidation. Wynn at Law LLC’s debt relief lawyers can explain the benefits of a Chapter 128 debt amortization plan and review the advantages of using a Chapter 128 as an alternative to bankruptcy.

As with most other legal matters, any person may represent himself or herself before the court. Bankruptcy is a highly refined procedure that is full of detail and interpretations based on prior case law. Each case is different.

A lawyer will make filing for bankruptcy easier, faster, and more successful. The legal advice of an experienced law firm can help individuals make a more informed decision and avoid costly mistakes. The laws and logistics of bankruptcy, credit reporting bureaucracy, and the tactics of collection agencies can be difficult to manage without a lawyer.

In virtually all cases, the total expense of bills, late fees, and interest are far more expensive than the cost of declaring bankruptcy. It is often better to find solutions to help manage debt rather than continuing to exhaust assets in an attempt to avoid bankruptcy.

Many people wait to visit a law firm because they worry about the cost, but this is the wrong approach. The sooner the process begins, the more money a knowledgeable debt relief lawyer can save a client. As time passes, individuals may miss the chance to use non-bankruptcy solutions. Many alternatives are less expensive than bankruptcy – in fact, some are free.

It is also worth noting that the costs of filing for bankruptcy will depend on the chapter or type of bankruptcy. For example, if an individual files for Chapter 13 Bankruptcy, he/she can start the process with a down payment and then pay the remaining balance as part of the repayment plan. Some individuals may also qualify for legal aid through Legal Action of Wisconsin (Racine). This office helps qualifying residents of Walworth County and Kenosha County reduce the overall cost of bankruptcy.

The cost of a bankruptcy lawyer in Wisconsin starts at around $1,500.00. But beware of cheap lawyers. These low-cost options may not thoroughly check to make sure that bankruptcy is the best choice. Wynn at Law, LLC helps clients explore ALL of their options in order to discover the best solution for their unique situation.

Wynn at Law, LLC understands that bankruptcy clients are under financial distress. To help assist clients, Wynn at Law, LLC offers two types of payment plans. There is a standard plan which requires a monthly payment of $125 and customized plans for special circumstances.

Bankruptcy is a complex process that will vary based on individual circumstances. It is best to consult with a lawyer prior to taking any action. The bankruptcy lawyer will help you navigate personal circumstances before, during, and after filing for bankruptcy.

Yes. After filing, an individual can keep their exempted property. An individual is also able to own assets that are obtained after bankruptcy. However, an individual may have to pay creditors using money received from an inheritance or life insurance benefit if it is received within 180 days of filing for bankruptcy.

In most cases, an individual is able to keep his/her home and vehicle(s). If maintaining ownership of a home or car is a priority – it is best to consult with a bankruptcy lawyer to create a personalized approach to filing for bankruptcy.

While most types of consumer debt are dischargeable through bankruptcy, there are specific debts that can not be discharged. For example, an individual may still be responsible for:

The dischargeability of debt will depend on the type of bankruptcy used. Wynn at Law LLC’s experienced lawyers will review and explain which debts are dischargeable through bankruptcy.

In most Wisconsin bankruptcy cases, a client will not attend court in front of a bankruptcy judge in a courthouse. Instead, they will typically only have to attend a proceeding called the “meeting of creditors” or a “Section 341 meeting”. This meeting is held in a hearing room in front of a bankruptcy trustee. Creditors are notified of this meeting, but most creditors choose not to attend. Most of the time, the individual is questioned for a few minutes about his/her financial situation and the meeting ends quickly.

With that being said, there are many bankruptcy forms and work done prior to the meeting. Wynn at Law, LLC’s experienced attorneys manage this part of the case while keeping their clients informed. Cases for Wisconsin residents in Walworth County, Racine County and Kenosha County are filed in the Eastern District of Wisconsin.

Yes. Filing for bankruptcy can appear on a credit report for up to ten years. However, in a situation where it makes sense to file for bankruptcy, the individual’s credit score is likely already affected by bad debt. Bankruptcy can be a tool for discharging old debt that is negatively affecting a credit score currently and can help individuals rebuild his/her credit score. After filing for bankruptcy, an individual is in a better position to pay bills on time which will positively impact his/her credit score in the future.

“Shannon Wynn assisted us with one of the most difficult times in our lives in a professional and courteous manner. If you are looking for a bankruptcy attorney, we could not recommend her highly enough. She answered all of our questions in a clear, concise way and walked us through the entire process giving us honest explanations of the extremely confusing bankruptcy laws. She was friendly and fair and worked very hard to help us understand the entire process, and because of her efforts we never once felt like we didn’t know what to expect. We wish her nothing but the best with her practice and know that anyone who retains her services will be getting one outstanding lawyer.”

– David & Cheryl (Salem, WI – Chapter 7 Bankruptcy Client)

“Attorney Shannon Wynn did an excellent job of keeping me informed. I never had to guess at anything. She gives very clear directions and outlined what my expectations are and what her expectations are at the very first appointment. There were no hidden surprises. She followed my case from start to finish in under 6 months. I could send her an e-mail any time, and she would respond back in a timely fashion. She is very dependable and never made me feel ashamed of my debt. Making that first call to an attorney is probably one of the hardest things I have ever had to do, but I am sure happy that I called Shannon Wynn.”

– Kathy (Lake Geneva, WI – Chapter 7 Bankruptcy Client)

“The entire staff at Wynn at law was amazing. I was very hesitant about bankruptcy, looked at a lot of different options even after my appointment with attorney Wynn, and decided this was the best. From the first steps all the way to the last they were extremely helpful, polite, and never discouraged me or who I was due to filing bankruptcy, instead made me feel like this was a brand new beginning. Thank you Wynn at Law!!”

– Anonymous (Wisconsin Resident – Bankruptcy Client)

![]()

![]()

![]()

![]()

![]()

Attorney Shannon Wynn and Associates are fantastically outstanding! Their exceptional professionalism, patience, trust, integrity, genuine caring attitude, and legal knowledge is of the highest level. They have been there every step of the way, always offering help in any way possible. I would highly recommend Attorney Shannon Wynn and Associates/staff for general or specialized legal needs.

Lake Geneva, On-Site Review

![]()

![]()

![]()

![]()

![]()

I enjoyed working with Attorney Wilson and the Wynn Law team for my recent purchase of land. Not working with a realtor to purchase real estate had me nervous. The Wynn law team stepped in and helped me through the process from writing the offer to ensuring the items needed for close were done to representing me at closing. The team was easy and pleasant to work with. I'd highly recommend them.

Lake Geneva, On-Site Review

![]()

![]()

![]()

![]()

![]()

Attorney Wynn and her entire staff are wonderful! They are all easy to work with and very knowledgeable. Attorney Wynn was always understanding of my situation, and worked hard for me. She responded to any questions I had in a timely manner and her staff did the same. I would HIGHLY recommend Wynn at Law to anyone looking for an attorney!

Lake Geneva, On-Site Review![]()

![]()

![]()

![]()

![]()

We had a very good experience working with Shannon Wynn and her associates.She made us feel at ease and made the whole experience of Bankruptcy painless. We would recommend her to anybody that needed her services. She is such a nice lady and really cares about you and your family.

Lake Geneva, Google Review