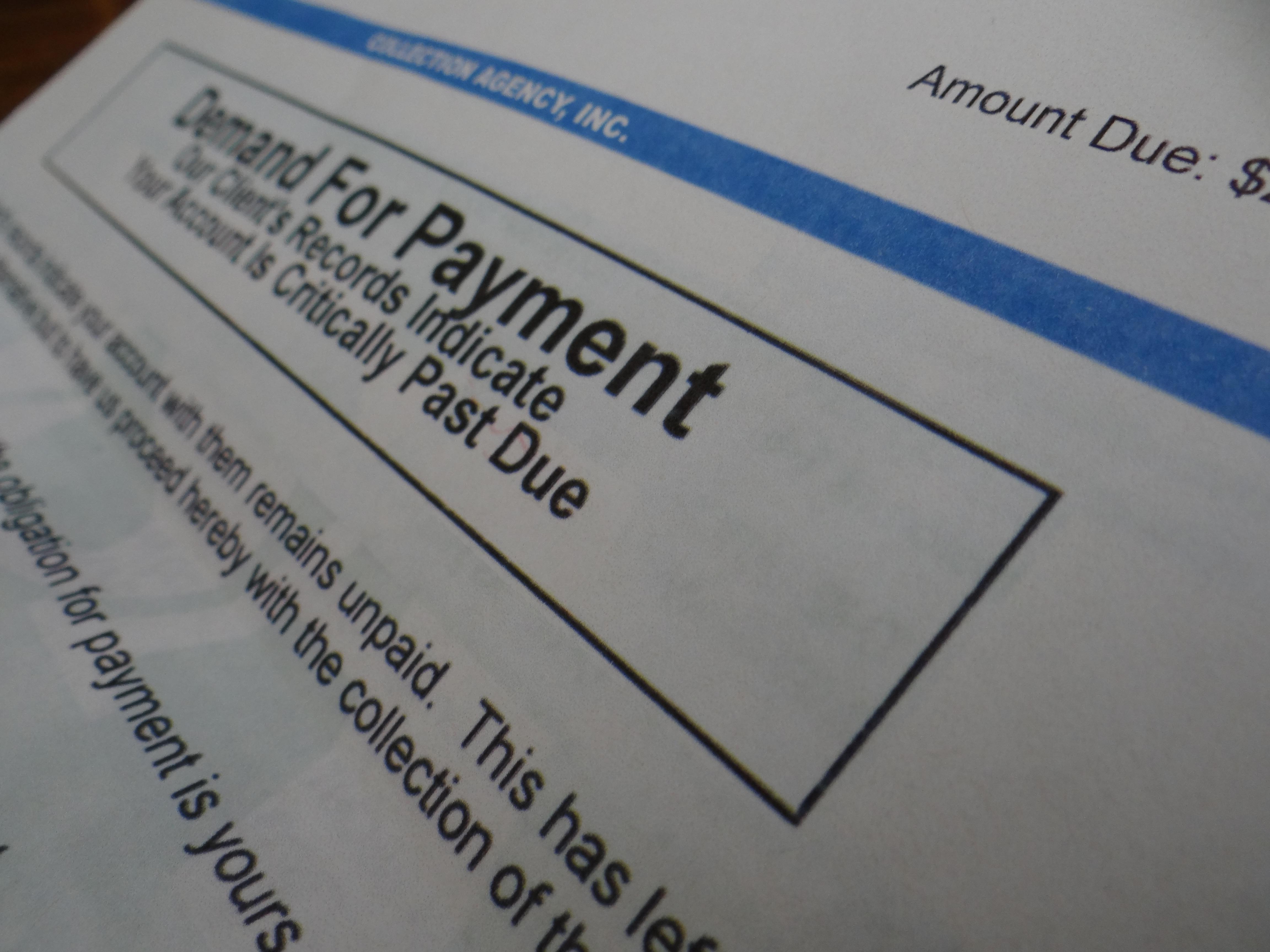

Is your current financial situation overwhelming? Does it feel like you are never going to get out of debt? Are you looking for a solution that does not involve declaring bankruptcy? If you live in Wisconsin and answered yes to any of these questions, you may be interested in a Chapter 128 Debt Amortization Plan.

Wynn at Law, LLC focuses on helping clients identify solutions when they are struggling with debt. Filing for bankruptcy is not the only option. Wynn at Law, LLC will work with you to find the best solution for your situation. Our approach makes sure that you understand your options and that all of your questions are answered during this difficult economic time. Schedule a free consultation with our experienced attorneys to discuss your options.

A Wisconsin Chapter 128 Debt Amortization Plan is a low-cost alternative to bankruptcy using debt consolidation. This alternative will pause accruing interest and late fees, stop wage garnishment and does not require a court appearance in the majority of cases. A Chapter 128 is a faster and easier path to debt relief than filing for federal bankruptcy. Individuals who file for a Chapter 128 pay off their debt in three years or less.

The best way to fully understand your options is to meet with an experienced attorney at Wynn at Law, LLC.

There are complicated differences between a Chapter 128 and filing for bankruptcy. However, filing for a Chapter 128 is often considered a simpler and easier process. To file a Chapter 128 Debt Amortization Plan, the individual must be a Wisconsin resident and must be able to prove he/she has a consistent source of income.

When filing for a Chapter 128, an Affidavit of Indebtedness must be submitted along with a Petition to Amortize Debts and an Order. A neutral third-party trustee will then be appointed to oversee the collection of money and payments to creditors. Finally, all debts included in the Chapter 128 plan must be paid in full according to the schedule outlined in the payment (amortization) plan.

Individuals are not required to include all debt in a Chapter 128 plan. This enables you to structure your personalized debt plan to include only specific debts that make sense for your situation. A Chapter 128 can cover the unsecured debt such as credit cards, payday loans and medical debt. Secured debt, such as vehicle loans or home mortgages, cannot be included in a Chapter 128.

The following types of debt are commonly included in a Chapter 128 Plan:

There are special circumstances for each of the items listed above and additional types of debt may also be included in a Chapter 128. By working with an experienced debt relief attorney, you will be able to identify the best debt restructuring for your Chapter 128 Debt Amortization Plan.

A Chapter 128 Debt Amortization Plan can be a great alternative to bankruptcy. Below is a list of the reasons why an individual may choose a Chapter 128 over bankruptcy:

An experienced Wisconsin debt relief attorney can help you identify the best option for your situation. She can also help you evaluate what debt can and should be included in your Chapter 128 Affidavit of Indebtedness. While you are not required to have an attorney to file a Chapter 128, it will increase the likelihood of success and will make the process easier to manage. Learn more.

Wynn at Law, LLC’s multiple office locations in Lake Geneva, WI, Delavan, WI, and Salem Lakes, WI allow its attorneys to conveniently serve all of Southeastern Wisconsin. If you are in need of an attorney for debt relief, please call 262-725-0175 or send us a quick online contact form.

![]()

![]()

![]()

![]()

![]()

Attorney Shannon Wynn and Associates are fantastically outstanding! Their exceptional professionalism, patience, trust, integrity, genuine caring attitude, and legal knowledge is of the highest level. They have been there every step of the way, always offering help in any way possible. I would highly recommend Attorney Shannon Wynn and Associates/staff for general or specialized legal needs.

Lake Geneva, On-Site Review

![]()

![]()

![]()

![]()

![]()

I enjoyed working with Attorney Wilson and the Wynn Law team for my recent purchase of land. Not working with a realtor to purchase real estate had me nervous. The Wynn law team stepped in and helped me through the process from writing the offer to ensuring the items needed for close were done to representing me at closing. The team was easy and pleasant to work with. I'd highly recommend them.

Lake Geneva, On-Site Review

![]()

![]()

![]()

![]()

![]()

Attorney Wynn and her entire staff are wonderful! They are all easy to work with and very knowledgeable. Attorney Wynn was always understanding of my situation, and worked hard for me. She responded to any questions I had in a timely manner and her staff did the same. I would HIGHLY recommend Wynn at Law to anyone looking for an attorney!

Lake Geneva, On-Site Review![]()

![]()

![]()

![]()

![]()

We had a very good experience working with Shannon Wynn and her associates.She made us feel at ease and made the whole experience of Bankruptcy painless. We would recommend her to anybody that needed her services. She is such a nice lady and really cares about you and your family.

Lake Geneva, Google Review